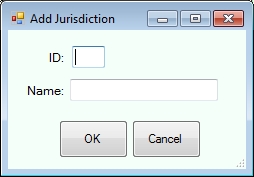

The Add Jurisdiction Form is used to input the information needed to set up a new tax jurisdiction for which you want to enter rate information for Instant Interest to keep. It is accessed by clicking on the "Add Juris" button on the Rate Maintenance tab and looks like this:

It consists of the following elements:

- Jurisdiction ID — a two or three character abbreviation for the Tax Jurisdiction; the official U.S. Postal Service abbreviation is used for all states whose rates are maintained in the Instant Interest rate file;

- Jurisdiction Name;

- an OK Button to add the data as entered; and

- a Cancel Button to cancel the add operation.

In order to add rates for a jurisdiction which is not maintained in the Instant Interest rate file by C&C Software, you must first add the Jurisdiction using the "Add Jurisdiction" panel to set up the jurisdiction and then use the "Add Rate" panel to add rate records.