In some cases you may have decided on filing to apply an overpayment from a return to an installment payment due for the succeeding return year. Section 301.6402-3(a)(5) provides that no interest will be paid on any overpayment which is elected to be applied to the succeeding tax year or installments thereof. If you filed the appropriate extension requests to file your tax return on 9/15 from 3/15 then in effect the IRS has had the interest-free use of your overpayment from 3/15 to 9/15 or to whatever quarterly installment you elected to have the payment applied against. If later, on audit, it is determined you owe additional tax for the refund year the IRS should not calculate interest on the amount of the overpayment for the period of time between the original due date and the date of the installment payment for which the overpayment was elected to be applied.

Note: Under Revenue Ruling 84-58 the overpayment will be applied against the first quarter estimated tax installment unless an election to specifically apply the overpayment to a different quarterly installment is made.

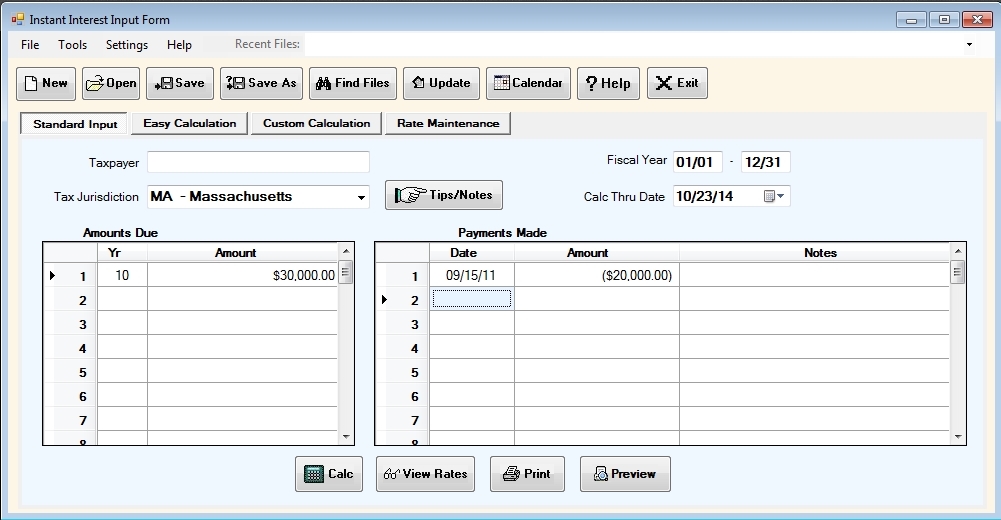

A calendar year taxpayer is granted an additional 3-month extension to file its 2010 tax return on September 15, 2011 (after filing the automatic extension request from the original due date of March 15, 2011). A $20,000 overpayment from the 2010 return is specifically elected to be applied against the third installment payment for 2011 due September 15, 2011. On June 1, 2011, the taxpayer is assessed a $50,000 deficiency for tax year 2010. The taxpayer wishes to pay the deficiency on October 23, 2014. Interest would be calculated on $30,000 ($50,000 assessment less the $20,000 overpayment) from March 15, 2011 to September 15, 2011, and on the $50,000 from September 16, 2011 to October 23, 2014. The entries to the Instant Interest screen would be as follows:

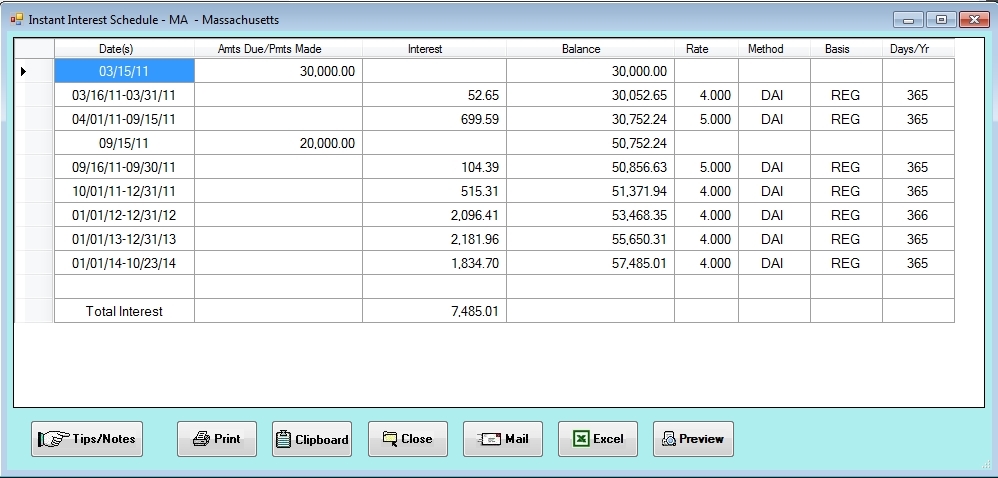

This would yield the following interest schedule:

Note: If the installment payment was not specified for which the overpayment was to be applied the IRS would only allow the interest benefit to the first installment payment due 4/15/11 instead of the more advantageous date of 9/15/11.