The State of Ohio has a tiered system in determining interest on underpayments. For example, a calendar year taxpayer is found upon audit to have underpaid recomputed tax of $75,000 by $30,000 for tax year 2013. An extension request had been filed. Original tax of $45,000 had been paid in $15,000 increments on 1/31/14, 3/31/14, and 5/30/14. The state will charge interest on one third of the $30,000 underpayment ($10,000) beginning January 31, 2014. Interest on two thirds of the underpayment ($20,000) will be charged beginning March 31, 2014 and interest on the entire $45,000 will begin May 31, 2014. (Had no extension request been filed interest on one third of the underpayment ($10,000) would begin January 31 and interest on 100% of the underpayment ($30,000) would begin March 31).

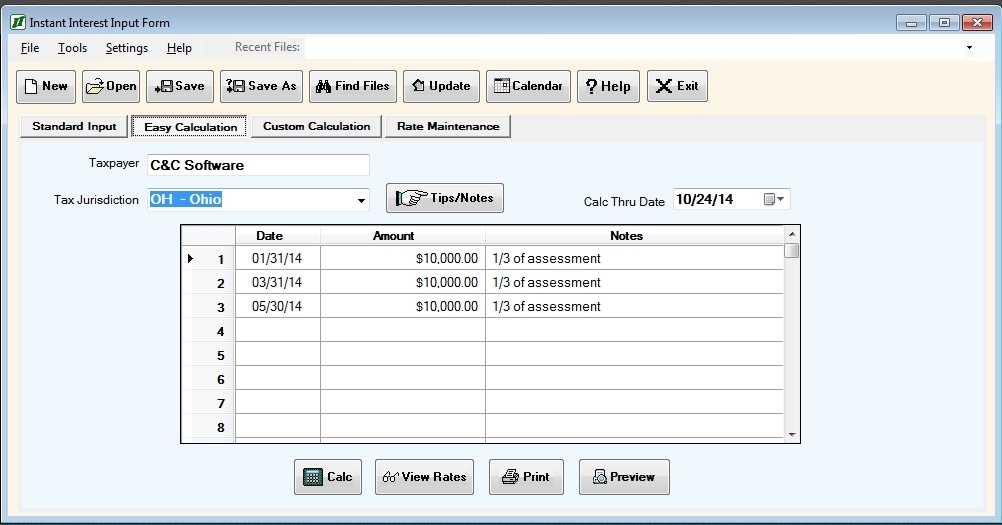

This scenario can be easily accommodated by Instant Interest. On the Easy Calculation screen enter $10,000 on 1/31/14, 3/31/14 and 5/31/14. Also enter the date through which you wish to calculate interest, as follows:

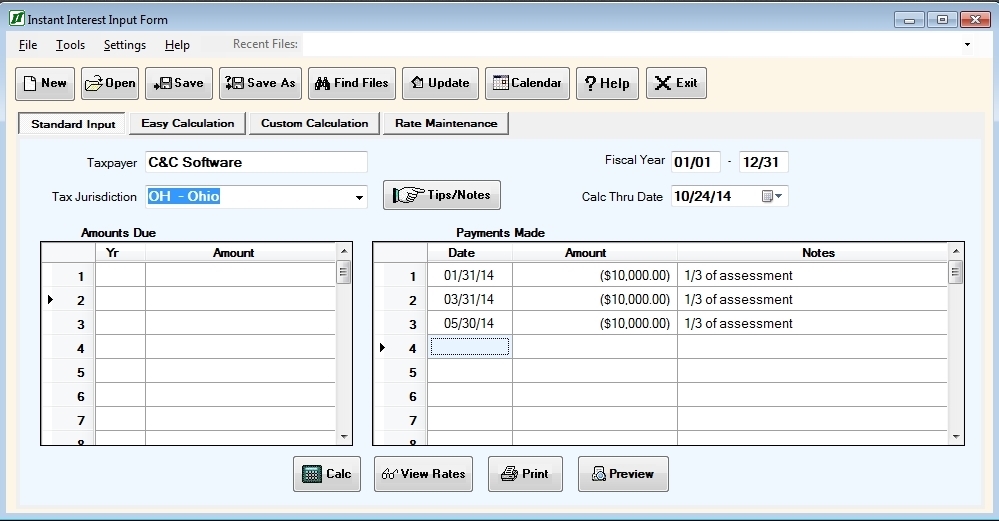

Note: You could also use the Standard Input screen by entering the $10,000 amounts as negative amounts (additional amounts due) on the “Payments Made” side of the input screen, as follows:

If you use the Standard Input screen, leave the year field blank in the “Amounts Due” column. If you enter 2013 in the “Amounts Due” column the program by default will not calculate interest on the 1/31/14 amount or any amounts before the due date of the return which for a calendar year would be 3/31/14.

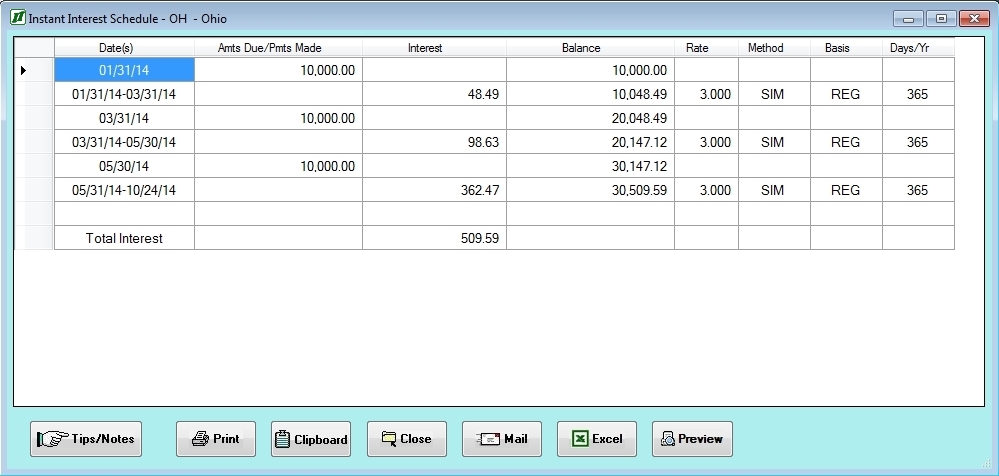

In either case (whether you use the Standard Input or Easy Calculation form to enter the data), the resulting interest schedule will look like this:

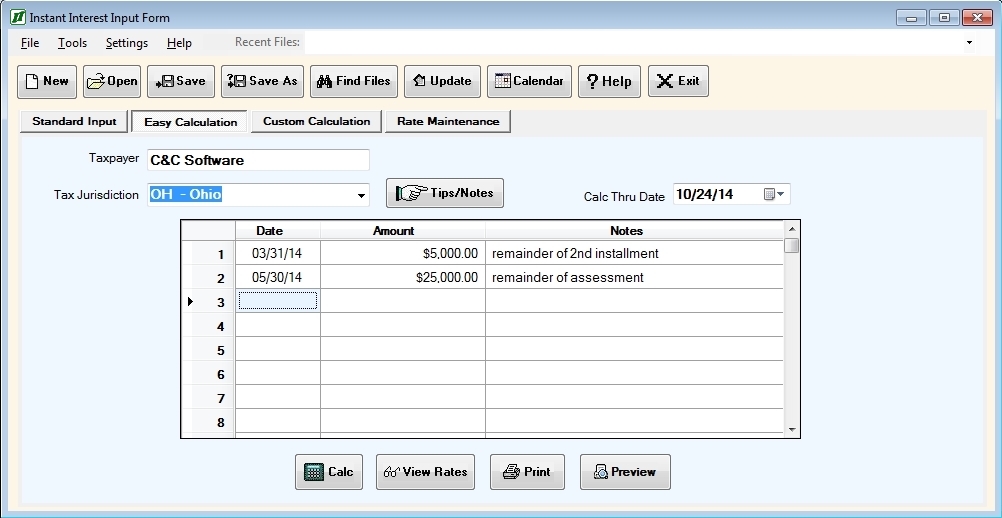

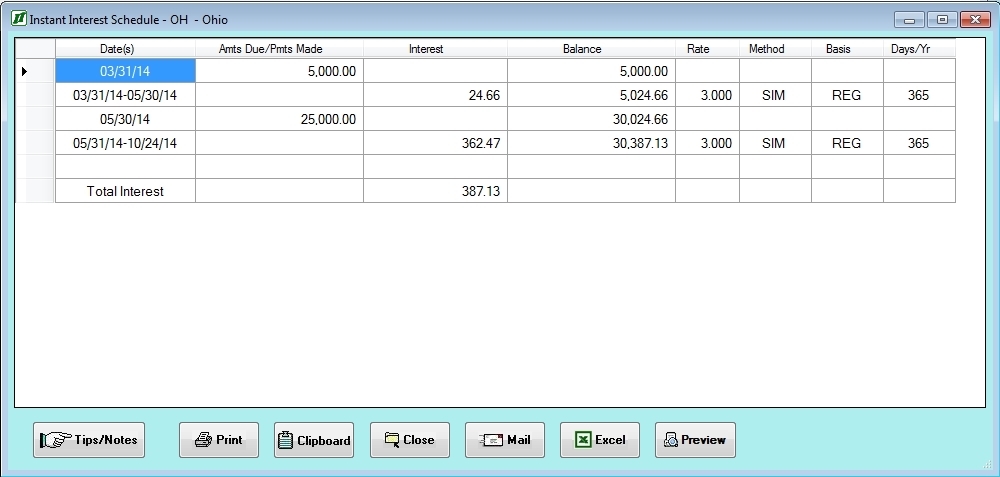

If in the scenario outlined above, the taxpayer had paid the original tax of $45,000 by January 31, 2014 the interest calculation would be different. Since the recomputed tax of $75,000 should have been paid (with an extension request) in three equal payments of $25,000 the $45,000 payment on 1/31/14 satisfies the first payment requirement with the $20,000 remainder carrying over to the second payment due 3/31/14. Interest would be calculated, therefore, on $5,000 beginning 3/31/14 with interest beginning on the remaining $25,000 ($45,000 total) on 5/30/14 as follows:

In this case the resulting interest schedule would look like this: