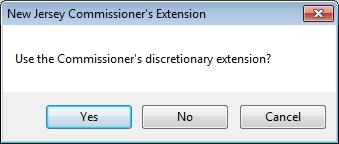

Interest on extensions or discretionary reductions approved by the New Jersey Division of Taxation is calculated at a lower rate than on other types of underpayments. Prior to January 1, 1988, the Division of Taxation could at its discretion waive interest in excess of 9%. Since January 1, 1988, the normal interest rate for underpayments is set quarterly at 5% above prime. (This is the rate you would see for the periods since January 1, 1988, if you were to use the View menu option to look at the rates.) The interest rate for extensions is 3% above prime or 2 points below the normal rate. Before calculating the interest on a New Jersey assessment Instant Interest will prompt you as follows:

If you select “Yes” the reduced rate will be used. If you select “No” the regular published rate will be used.

The Commissioner’s discretionary reduction for the state of New Jersey was discontinued as of July 7, 1993.