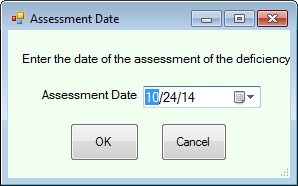

Section 67-1-801 of the Tennessee Code Annotated specifies that the rate in effect at the time of the assessment applies to all previous tax periods. Instant Interest, therefore, prompts the user for the Assessment Date as follows:

Whatever rate was in effect as of the date entered by the user will be used for all prior periods as well.