The following tax jurisdictions have special regulations that may require the entry of a notification date in order to calculate an interest schedule:

CA – California FED – Federal OR – Oregon VA – Virginia

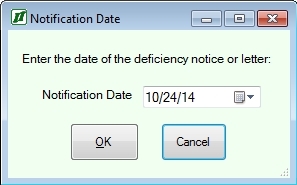

Whenever a calculation is performed and the requisite conditions are met (see the pages referenced in the Related Topics section below for details) the following panel will be displayed:

The Notification Date should be entered in MM/DD/YY format or you may click on the Pick button to display a calendar from which you can select a date. If you click on OK an interest schedule will be generated using the date entered. If you click on Cancel the calculation operation will be abandoned and you will be returned to the appropriate input form.